The Siren's Song of Low Unemployment

You may remember reading about the siren in Greek Mythology. The siren was a creature that would lure unsuspecting sailors to their destruction with its beautiful voice.

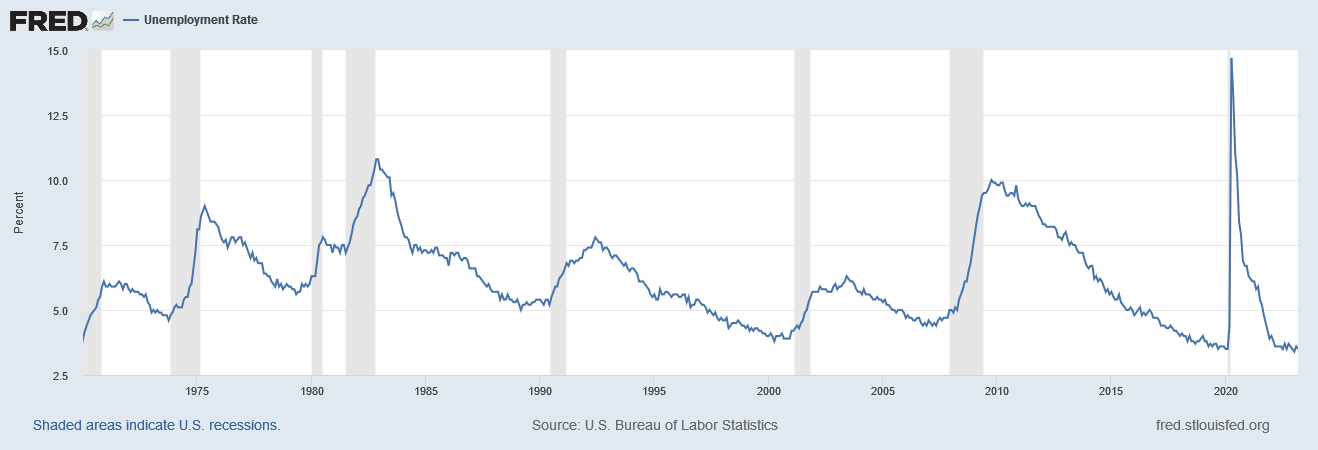

I fear that today’s unemployment figures may be doing the same thing to many Americans. You may have seen the headlines that the unemployment rate dropped to 3.5% last month. As you can see in the chart below, that is pretty good. Matter of fact, since 1970, a rate of 3.5% or lower has only happened in 8 out of the 638 months since 1970.

Source: St. Louis Federal Reserve Bank, FRED

That’s a really good thing for Americans and our economy…today.

But I’m concerned about what will happen next.

Do you see the shaded vertical lines on the chart? Those are recessions. Notice when recessions happen. When the unemployment rate is high, or low?

They happen when unemployment is low. In fact, the unemployment rate is considered a lagging economic indicator. This means that many other economic indicators like the yield curve, housing permits, and new orders for manufacturing give recession warnings before the unemployment rate does. All of those metrics are screaming that a recession is coming.

Not only are these reliable indicators pointing toward tough times ahead, but even the Federal Reserve says as much in the minutes from their March board meeting. John Mauldin, one of my favorite economists, mentions in his last weekly article of April 15th, Inflationary Choices, that the Fed never forecasts recession. And yet they are now forecasting a mild one to begin later this year.

And yet, they raised rates by a quarter of a percent anyway, and it was a unanimous decision by all seven voting members. This after Silicon Valley Bank failed the previous week.

It confirms what I’ve been thinking for a while. The Fed is actually trying to force us to slip into recession, because they knows that is the best way to kill inflation. I’m assuming they hope that they can kill inflation, and then re-stimulate the economy immediately without the recession getting too bad.

The danger is that the Fed has a tiger by the tail. Controlling the 300 million strong U.S. economy is easier said than done.

What’s the bottom line? Countless indicators and the Federal Reserve itself are pointing towards recession. Many investors are being deceived by the siren’s song that everything is okay since employment is strong.

But I think that will change. I don’t know when. But I’m confident it will.